8 tools to research your startup idea

What do you mean by “researching the ideas”? Of course, the hardest and the most time-consuming part of the research process is finding the target audience and doing interviews. It helps me understand if there is a problem worth fixing and if I can access my target audience. Besides that, I do my homework researching the competitors, calculating the market size, and learning the right vocabulary to talk with the customers.

In this piece, I want to share the tools I use to do my homework quickly and well enough to speak with customers and estimate the market opportunity — no philosophy this time, just a practical list of instruments.

YouTube interviews and podcasts with competitor’s founders

It is hard to find a founder of a startup, even a small one, who has never given interviews. It doesn’t matter how popular this interview is; usually, the less it is known, the more insights you can get from there. Startups won’t share their metrics or strategy on the website or in posts, but they will be happy to tell about it during the interviews. So, go to YouTube and type the name of the founder you want to get.

There is a guy, Nathan Latka, who understood it a long time ago, and he does interviews with founders and, based on their answers, creates the database of SaaS products with metrics he found out during the conversation. Check it out:

For example, here is the interview with the Fountain founder where you can see the MRR even in the title.

Web Archive

This one is a real treasure! You can check what any website looked like in the past, even if it doesn’t work anymore. I like to use the archive to understand the primary value proposition.

When the company becomes bigger, messaging on its websites becomes more broad because it covers lots of everything: many products, many industries, etc. Whereas, when the company is just starting, the messaging is clear and targets only one specific audience which is crucial to understand planning your product.

Example.

https://adplist.org/ Mentors marketplace today. You can find mentors from any industry.

The same marketplace in 2020. Wow! So, they started as a designer marketplace for hiring during COVID-19! They did a pivot to find a mentor in design and scaled it to other industries later.

Facebook Ads Library

https://www.facebook.com/ads/library/

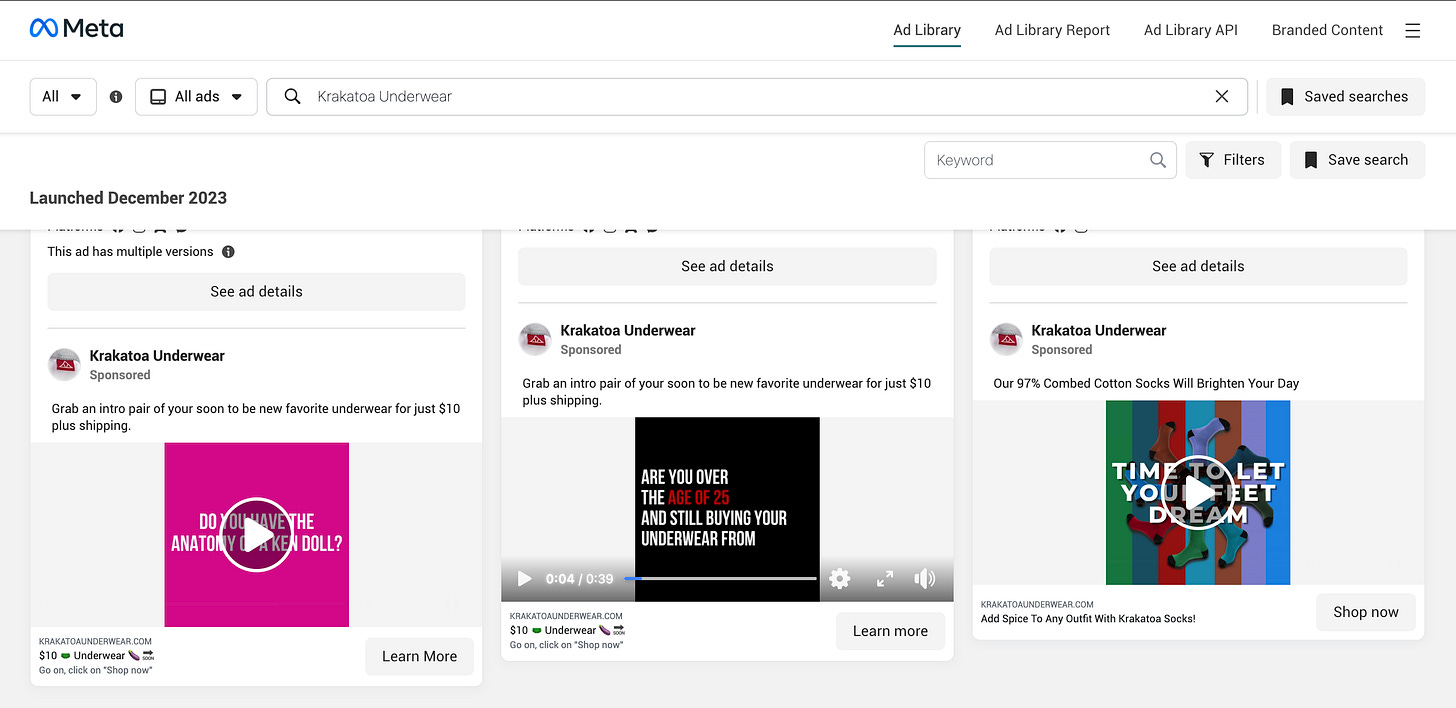

If the company I research does ads on Facebook, I can easily check this ad here.

I can see all active ad campaigns to understand better the strategy, target audience, and value proposition.

While researching the underwear brand Krakatoa, I knew from other sources that they are doing pretty well and ads work. From the Ads library, I found out that they use text videos in ad creatives and clearly show the value proposition.

SimilarWeb

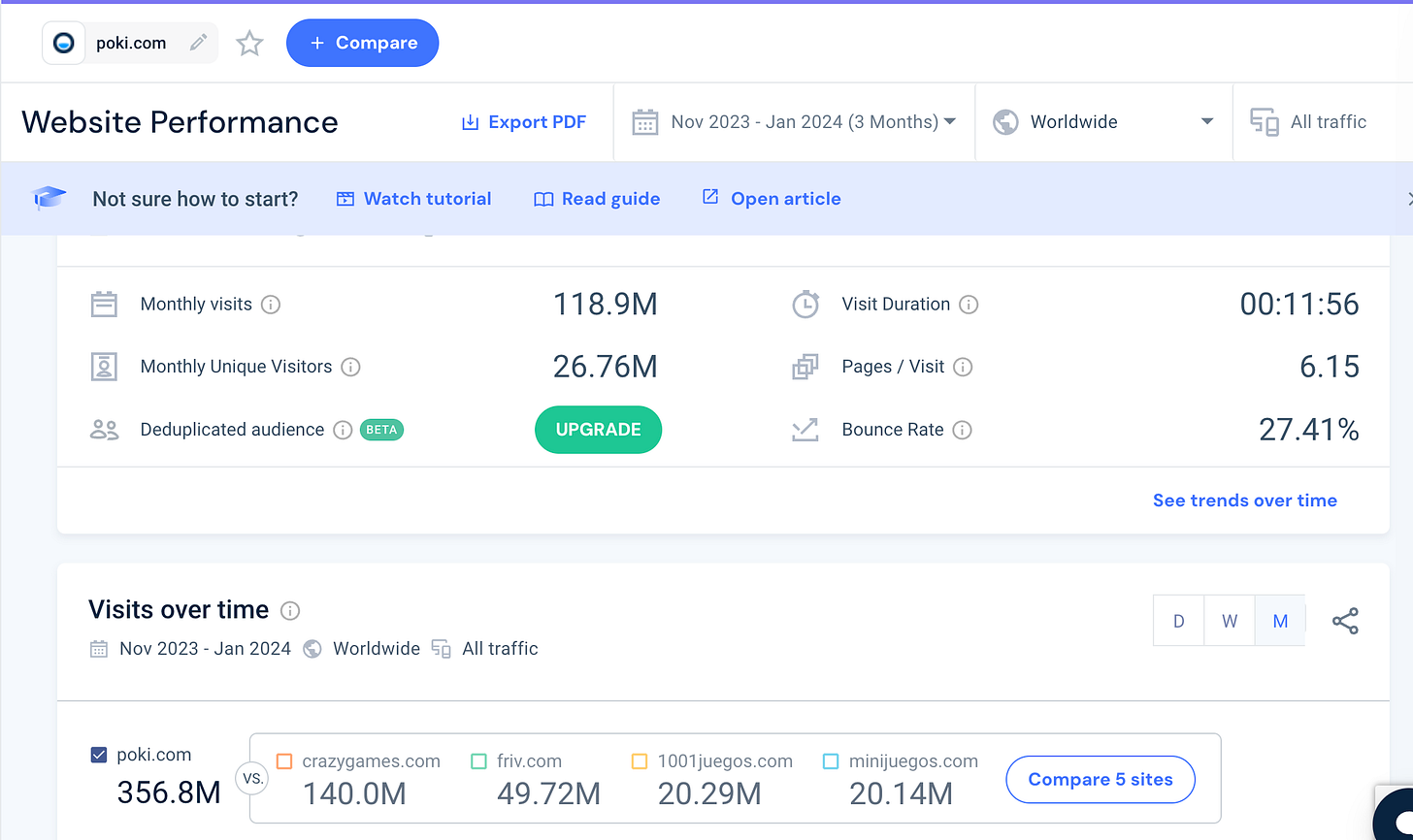

I check traffic on the company’s website to estimate demand, revenue, and the number of leads based on the average conversion rate in the industry. Of course, it is not super accurate, but it is more than enough for the research. Moreover, you can see traffic sources and understand what channels work for this company.

I researched browser-based games and was impressed that 120M people use poki.com to find and play a game which shows the demand for this type of gaming.

Annual Reports

https://www.annualreports.com/

When a company becomes public, it has to make public reports every year. Yes, they are usually 100 pages long and extremely boring, but you can get a picture of the strategy and financial models there.

Bonus. If the company is UK-based, you can find its yearly reports even for private entities. Crazy, but true! Check it out here:

https://find-and-update.company-information.service.gov.uk/

Last time, I researched a company, Unity, and found out they experienced issues with profits, and that is why I decided to change pricing. Whereas they received tons of negative comments, their reports showed huge growth in revenue and profits.

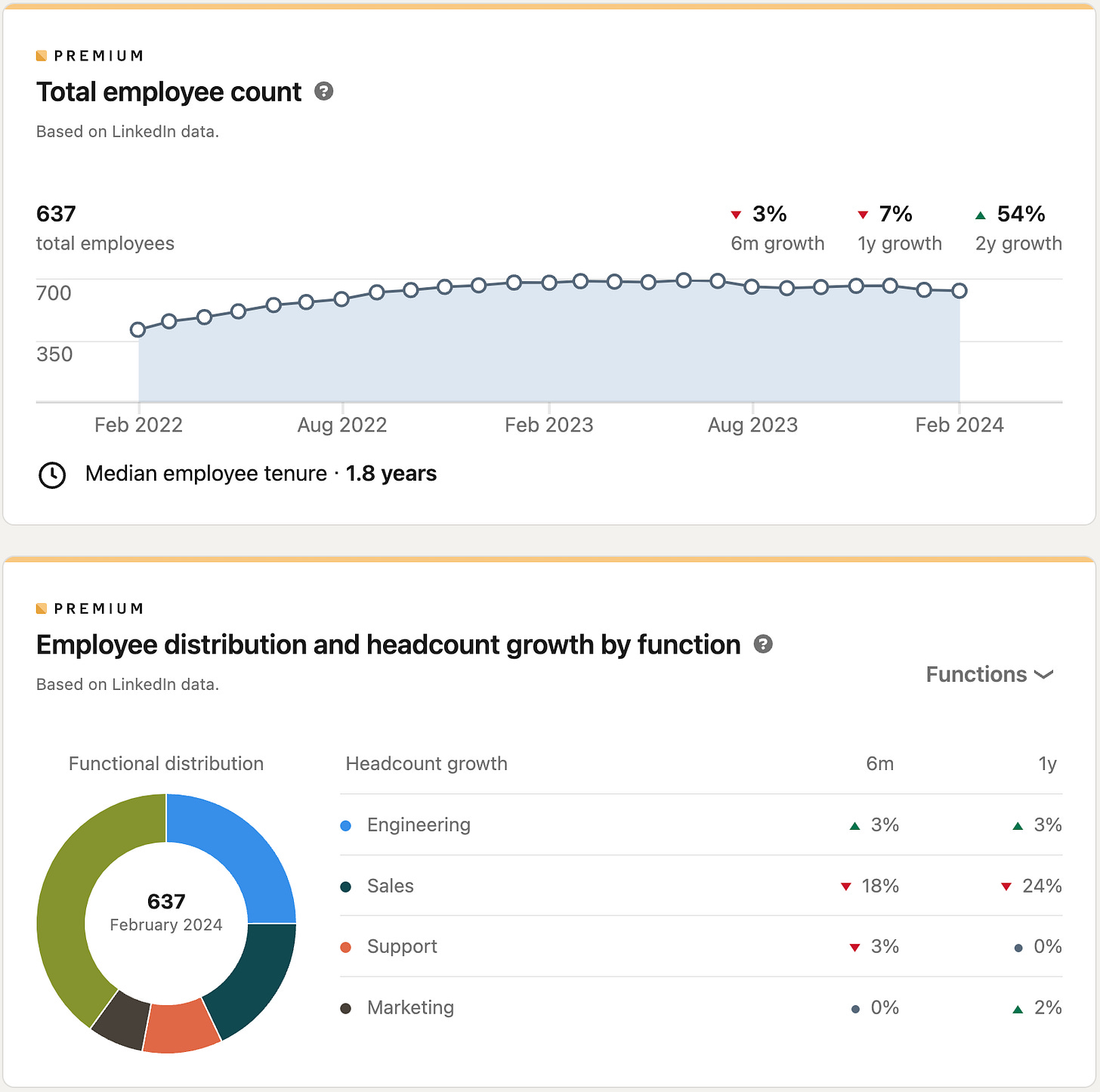

LinkedIn

I use LinkedIn to check the headcount, growth rate, and founders’ profiles. Sometimes, it is hard to find the growth rate of the company in revenue, and the second best alternative is a growth rate in headcount. If the company doubles the team during the year, it means it grew in revenue or raised money (which you can check with another tool). In both cases, it makes a picture of the market during the competitor’s research. Obviously, if the headcount is decreasing or stable, it also gives many insights compared with other competitors.

Example. Snapshot of Calendly profile showing they cut Sales Department.

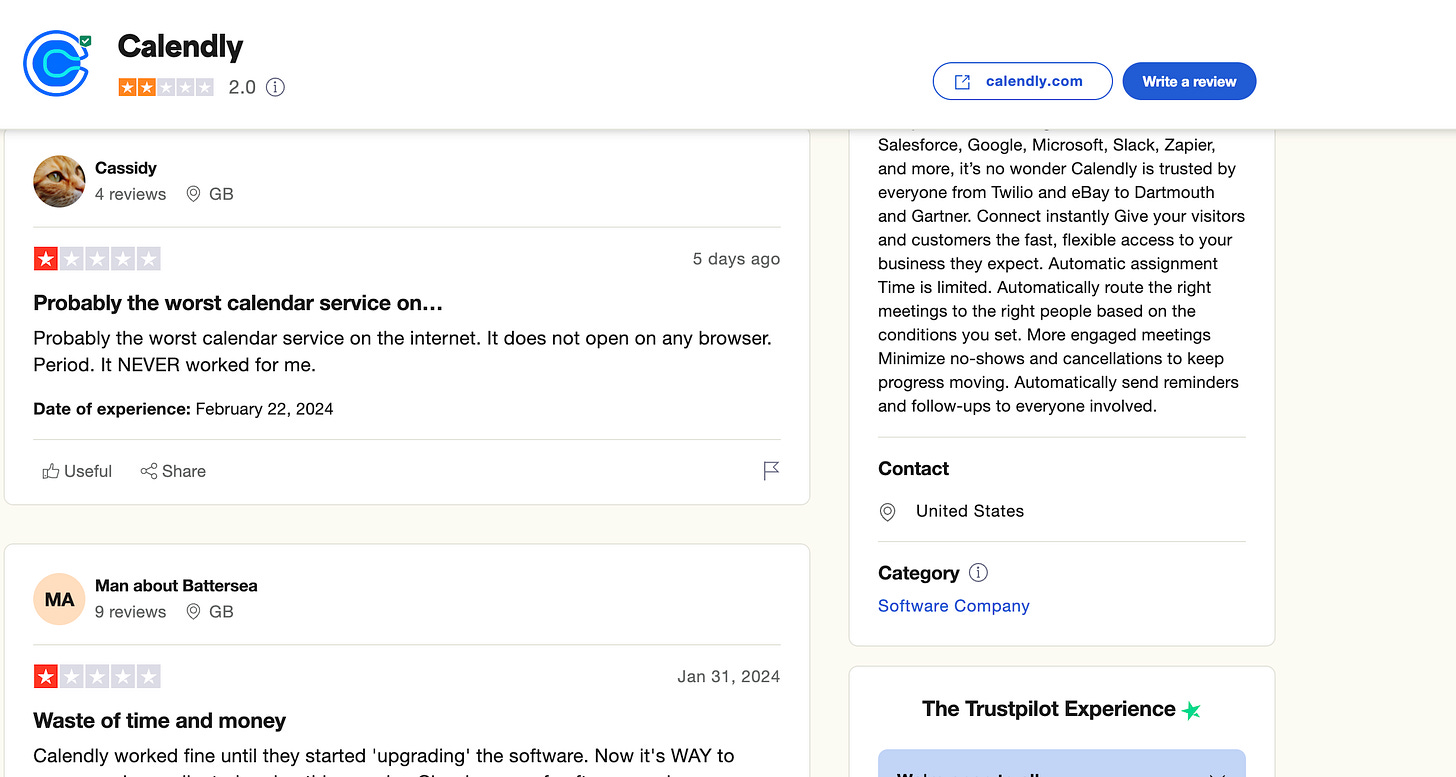

Glassdoor, TrustPilot, G2, Reddit, etc.

Feedback from current employees and customers. Who uses bots to write reviews, what problems do companies have inside, and what issues do customers experience with the product? All these data I usually can find checking customers’ and employees’ reviews on different platforms.

I use Calendly as my scheduling tool, and I love it. But it seems like many people don’t. The average mark is 2.0, which is the worst I’ve ever seen here. It makes me think that there is still an opportunity on the market.

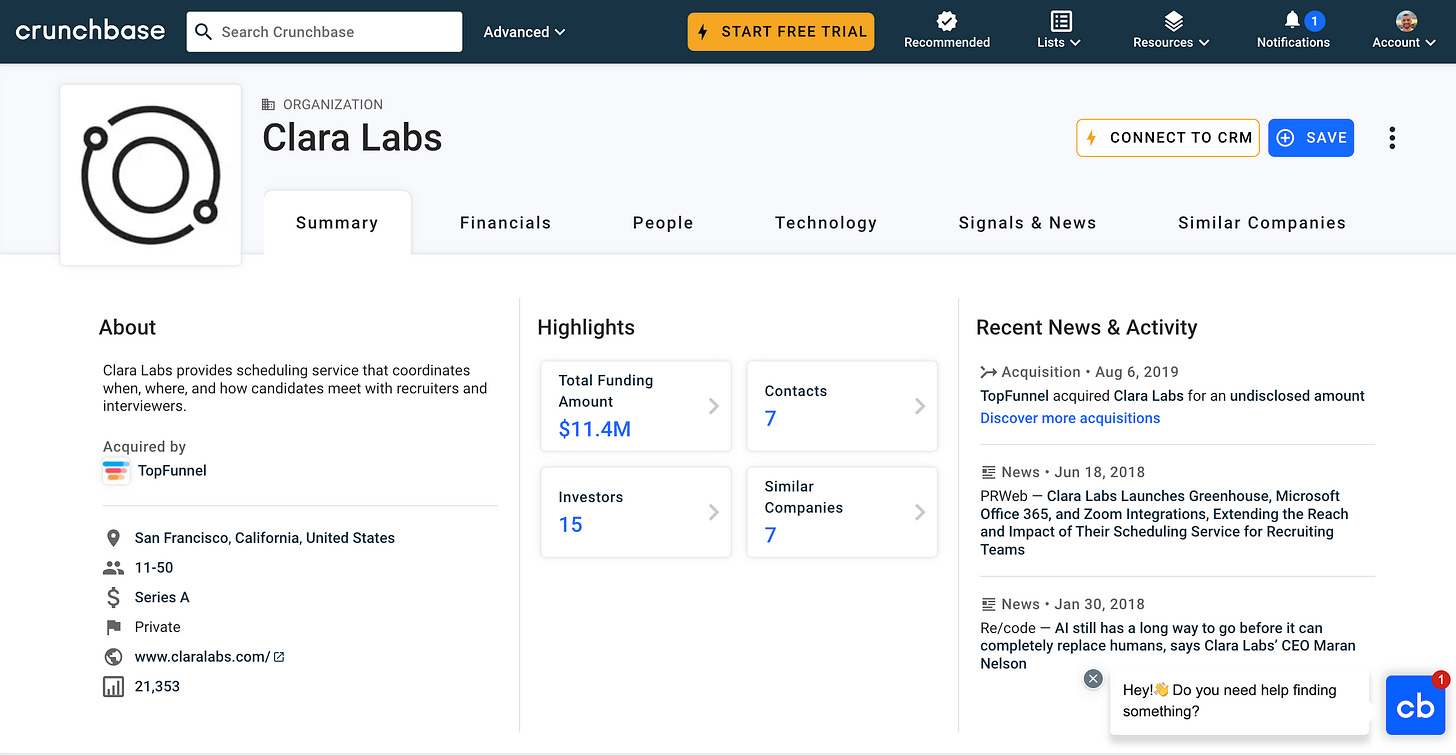

CrunchBase

Let’s end this list with the most obvious tool, which is pretty good for checking the fundraising history of the company. For example, I found a scheduling tool like Calendly, but it works like an AI assistant in your e-mail that helps you to schedule meetings. I was sure that it was new and they were starting, but at the end of the day, I checked Crunchbase and found out they raised $11M and were already acquired!

That is how it works for me! Let me know what you think. What tools do you use?

Will be happy to try!

Thanks for reading; I hope it helps!

Best,

Vitalii